Business-to-business payments platform Nium announced Monday that it raised more than $200 million in Series D funding and saw its valuation rise above $1 billion.

The company, now Singapore-based but shifting to the Bay Area, touted the investment as making it “the first B2B payments unicorn from Southeast Asia.”

Riverwood Capital led the round, in which Temasek, Visa, Vertex Ventures, Atinum Capital, Beacon Venture Capital and Rocket Capital Investment participated, along with a group of angel investors like DoorDash’s Gokul Rajaram, FIS’ Vicky Bindra and Tribe Capital’s Arjun Sethi. Including the new funding, Nium has raised $300 million to date, Prajit Nanu, co-founder and CEO, told TechCrunch.

The B2B payments sector is already hot, yet underpenetrated, according to some experts. To give an idea just how hot, Nium was seeking $150 million for its Series D round, received commitments of $300 million from eager investors and settled on $200 million, Nanu said.

“This is our fourth or fifth fundraise, but we have never had this kind of interest before — we even had our term sheets in five days,” he added. “I believe this interest is because we’ve successfully managed to create a global platform that is heavily regulated, which gives us access to a lot of networks. This is an environment where payment is visible, and our core is powering frictionless commerce and enabling anyone to use our platform.”

Nium’s new round adds fuel to a fire shared by a number of companies all going after a global B2B payments market valued at $120 trillion annually: last week, Paystand raised $50 million in Series C funding to make B2B payments cashless, while Dwolla raised $21 million for its API that allows companies to build and facilitate fast payments. In March, Higo brought in $3.3 million to do the same in Latin America, while Balance, developing a B2B payments platform that allows merchants to offer a variety of payment methods. raised $5.5 million in February.

Nium’s approach is to provide access to a global payment infrastructure, including card issuance, accounts receivable and payable, and banking-as-a-service through a single API. The company’s network enables customers to then send funds to more than 100 countries, pay out in more than 60 currencies, accept funds in seven currencies and issue cards in more than 40 countries, Nanu said. The company also boasts money transfer, card issuances and banking licenses in 11 jurisdictions.

Francisco Alvarez-Demalde, co-founding partner and managing partner at Riverwood, said in an email that the combination of software — plus regulatory licenses — and operating a fintech infrastructure platform on behalf of neobanks and corporates is a global trend experiencing hyper-growth.

Riverwood followed Nium for many years, and its future vision was what got the firm interested in being a part of this round. Alvarez-Demalde said that “Nium has the incredible combination of a great market opportunity, a talented founder and team, and we believe the company is poised for global growth based on underlying secular technology trends like increasing real-time payment capabilities and the proliferation of cross border commerce.

“As a central payment infrastructure in one API, Nium is a catalyst that unlocks cross-border payments, local accounts and card issuance with a network of local market licenses, partners and banking relationships to facilitate moving money across the world,” he added. “Enterprises of all types are embedding financial services as part of their consumer experience, and Nium is a key global enabler of this trend.”

Nanu said the new funding enables the company to move to the United States, which represents 3% of Nium’s revenue. He wants to increase that to 20% over the next 18 months, as well as expand in Latin America. The investment also gives the company a 12- to 18-month runway for further M&A activity. In June, Nium acquired virtual card issuance company Ixaris, and in July acquired Wirecard Forex India to expose it to India’s market. He also plans to expand the company’s payments network infrastructure, invest in product development and add to Nium’s 700-person headcount.

Nium already counts hundreds of enterprise companies as clients and plans to onboard thousands more in the next year. The company processes $8 billion in payments annually and has issued more than 30 million virtual cards since 2015. Meanwhile, revenue grew by over 280% year over year.

All of this growth puts the company on a trajectory for an initial public offering, Nanu said. He has already spoken to people who will help the company formally kick off that journey in the first quarter of 2022.

“Unlike other companies that raise money for new products, we aim to expand in the existing sets of what we do,” Nanu said. “The U.S. is a new market, but we have a good brand and will use the new round to provide a better experience to the customer.”

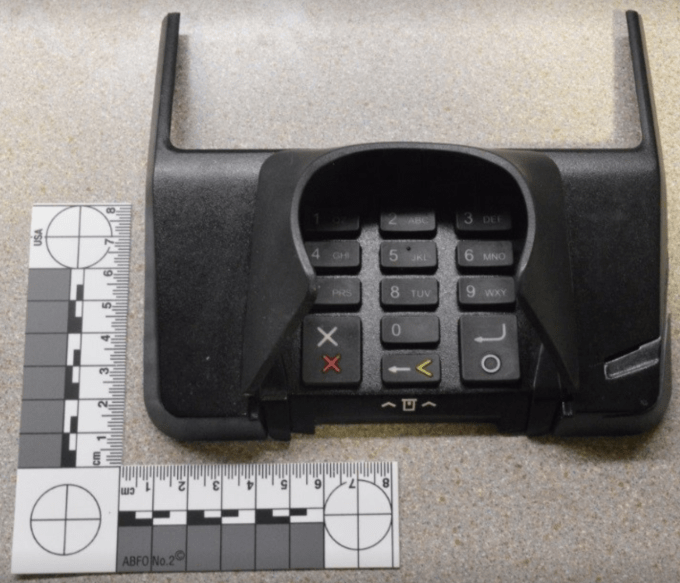

Police in Lower Pottsgrove, Pennsylvania have spotted a group of thieves who are placing completely camouflaged skimmers on top of credit card terminals in Aldi stores. The skimmers, which the gang placed in plain sight of surveillance video cameras, look exactly like the original credit card terminals but would store debit card numbers and PINs of unsuspecting shoppers. “While Aldi…

Police in Lower Pottsgrove, Pennsylvania have spotted a group of thieves who are placing completely camouflaged skimmers on top of credit card terminals in Aldi stores. The skimmers, which the gang placed in plain sight of surveillance video cameras, look exactly like the original credit card terminals but would store debit card numbers and PINs of unsuspecting shoppers. “While Aldi…  iZettle — the commerce platform based out of Stockholm that competes against companies like Square, Paypal and SumUp to provide card transactions using smartphones and tablets as well as related accounting services — has raised another €40 million ($47 million) as it approaches a $1 billion valuation. CEO and co-founder Jacob de Geer told TechCrunch the money will go towards…

iZettle — the commerce platform based out of Stockholm that competes against companies like Square, Paypal and SumUp to provide card transactions using smartphones and tablets as well as related accounting services — has raised another €40 million ($47 million) as it approaches a $1 billion valuation. CEO and co-founder Jacob de Geer told TechCrunch the money will go towards…  The number of startups hoping to break through into the world of payments appears to be shrinking a little bit more. Flint Mobile, a startup backed by the likes of Verizon and True Ventures, has ceased payment operations, and this week it started directing its customers to use Stripe for payments services. The shutdown has been slow and confusing, it seems. We have been trying to reach out…

The number of startups hoping to break through into the world of payments appears to be shrinking a little bit more. Flint Mobile, a startup backed by the likes of Verizon and True Ventures, has ceased payment operations, and this week it started directing its customers to use Stripe for payments services. The shutdown has been slow and confusing, it seems. We have been trying to reach out…  Appcelerator has been acquired. The mobile app development platform that counts the likes of T-Mobile, PayPal and GameStop among its customers has been bought by the B2B enterprise company Axway in an all-cash deal.

Appcelerator has been acquired. The mobile app development platform that counts the likes of T-Mobile, PayPal and GameStop among its customers has been bought by the B2B enterprise company Axway in an all-cash deal. Google is reportedly eyeing up an acquisition of Softcard to expand Google Wallet services to more points of sale with retailers; but it also wants to grow its position in the wider world of mobile-based transactions to compete with the likes of PayPal, by way of its Instant Buy API. Originally launched for Android in 2013, today the Instant Buy API is taking a step forward: Google is looking…

Google is reportedly eyeing up an acquisition of Softcard to expand Google Wallet services to more points of sale with retailers; but it also wants to grow its position in the wider world of mobile-based transactions to compete with the likes of PayPal, by way of its Instant Buy API. Originally launched for Android in 2013, today the Instant Buy API is taking a step forward: Google is looking…  Just days after Dutch digital commerce provider Adyen announced a $250 million round of funding, another heavily capitalised player in the space has made an acquisition to up its game. Mozido, a mobile commerce specialist that raised $185 million in October 2014 after raising $103 million in May, has taken a majority stake in CorFire, another mobile commerce startup that focuses on…

Just days after Dutch digital commerce provider Adyen announced a $250 million round of funding, another heavily capitalised player in the space has made an acquisition to up its game. Mozido, a mobile commerce specialist that raised $185 million in October 2014 after raising $103 million in May, has taken a majority stake in CorFire, another mobile commerce startup that focuses on…  It’s a little more modest than the $100 million in funding announced last month, but Revel Systems, makers of an iPad point-of-sale product of the same name, is picking up yet more capital. This time, it’s a grant of $1.2 million, from Invest Northern Ireland, for Revel to open an office in the capital of Belfast.

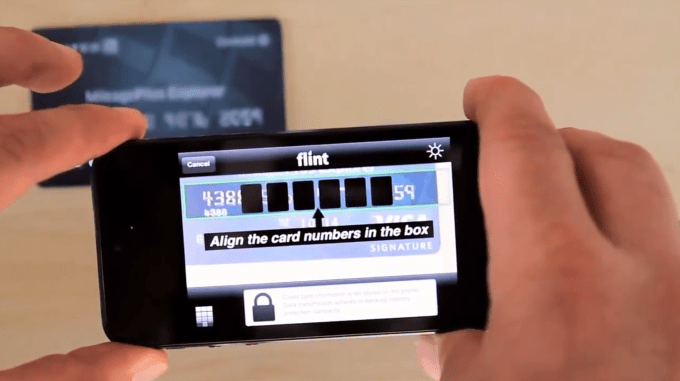

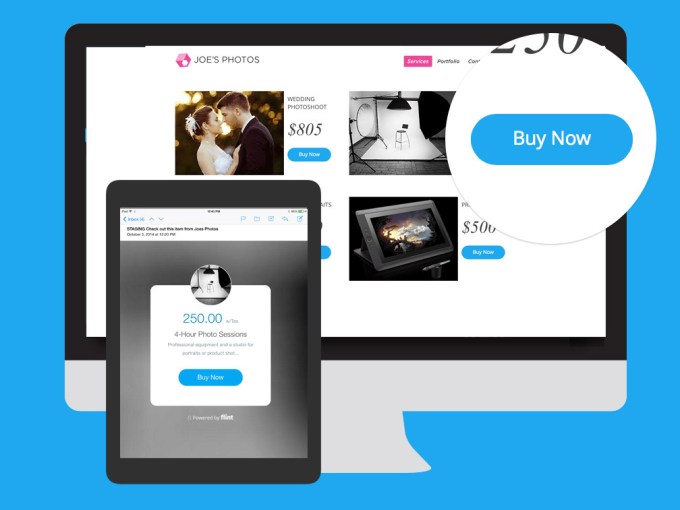

It’s a little more modest than the $100 million in funding announced last month, but Revel Systems, makers of an iPad point-of-sale product of the same name, is picking up yet more capital. This time, it’s a grant of $1.2 million, from Invest Northern Ireland, for Revel to open an office in the capital of Belfast. Flint Mobile, a point-of-sale mobile payments solution originally built around snapping photos of your credit card instead of dongles or using other hardware to make payments, is today announcing that it has raised another $9.4 million in funding led by new, strategic investor Verizon via its Verizon Ventures arm; as well as an expansion of its service to the wider internet in a new…

Flint Mobile, a point-of-sale mobile payments solution originally built around snapping photos of your credit card instead of dongles or using other hardware to make payments, is today announcing that it has raised another $9.4 million in funding led by new, strategic investor Verizon via its Verizon Ventures arm; as well as an expansion of its service to the wider internet in a new…