Hot off the heels of our look into Marqeta’s IPO filing and dives into SPACs for Bright Machines and Bird, we’re parsing the WalkMe IPO filing. Later this week, Squarespace will direct list and we’ll see IPOs from Oatly and Procore. It’s a super busy time for public debuts of all sorts.

Given how hectic the IPO market is, we’re going to skip our usual throat clearing and dig into WalkMe’s IPO document. As always, we’ll start with a brief overview of its product and then move into discussing its financial performance.

Image Credits: Alex Wilhelm

WalkMe is the second Israel-based technology company to file to go public this week: No-code startup Monday.com is also pursuing an American IPO.

Alright! Into the breach.

What does WalkMe do?

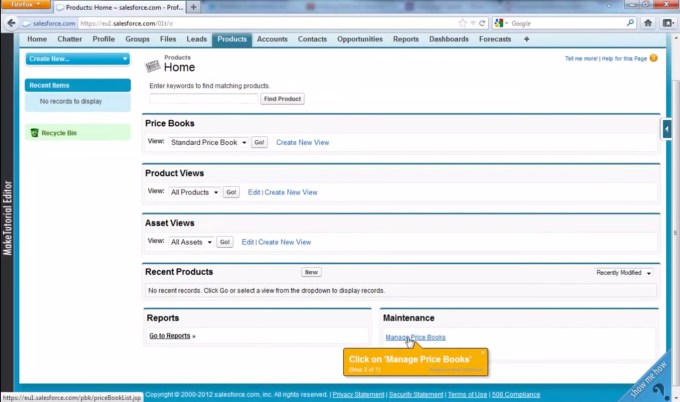

WalkMe’s software provides visual overlays on websites that help users navigate the product in question. I base that explanation on my time at Crunchbase, which was a customer during at least part of my time there. WalkMe is popular with marketing teams who want to introduce users to a new or refreshed experience.

Per the company’s F-1 filing, other elements of its service that matter include its onboarding system and what WalkMe calls Workstation, or its “single interface to the applications within an enterprise and simplifies task completion through a natural language conversational interface and automation.” We’re including that last feature because it says “automation,” which, in the wake of the UiPath IPO, is a word worth watching. Investors are.

At a high level, WalkMe is a SaaS business, which means that when we digest its results we are digging into a modern software company. Let’s do just that.

WalkMe’s numbers

From 2019 to 2020, WalkMe grew its revenues from $105.1 million to $148.3 million, a gain of 41%. In its most recent quarter, the company’s growth rate slowed: From Q1 2020 to Q1 2021, WalkMe’s top line grew 25% from $34.2 million to $42.7 million.

In SaaS terms, WalkMe calculates that its annual recurring revenue, or ARR, grew from $131.2 million at the end of 2019 to $164.3 million in 2020. In more granular terms, the company’s ARR grew from $137.8 million to $177.5 million in the first quarters of 2020, and 2021, respectively.

As more people and businesses shift to digital platforms to get things done, a cloud-based platform for making interfaces easier to navigate continues to grow. WalkMe, which helps guide people through confusing or complicated services online, has raised another $50 million in funding at a valuation TechCrunch understands from reliable sources is now around $400 million. The fundraise,…

As more people and businesses shift to digital platforms to get things done, a cloud-based platform for making interfaces easier to navigate continues to grow. WalkMe, which helps guide people through confusing or complicated services online, has raised another $50 million in funding at a valuation TechCrunch understands from reliable sources is now around $400 million. The fundraise,…  Confusing or complicated website and software design can cost companies a lot in lost traffic and business, but for one startup, it’s a problem that is proving to be lucrative. WalkMe, which has developed a platform that integrates with existing software and sites to help guide people through using them — used by companies like eBay, Salesforce and Expedia — has raised…

Confusing or complicated website and software design can cost companies a lot in lost traffic and business, but for one startup, it’s a problem that is proving to be lucrative. WalkMe, which has developed a platform that integrates with existing software and sites to help guide people through using them — used by companies like eBay, Salesforce and Expedia — has raised…  WalkMe, a platform that provides visual cues for website visitors so that users can navigate around them more easily, has raised $11 million in funding to expand its business and building out its customer base among enterprises.

WalkMe, a platform that provides visual cues for website visitors so that users can navigate around them more easily, has raised $11 million in funding to expand its business and building out its customer base among enterprises.