Factorial, a startup out of Barcelona that has built a platform that lets SMBs run human resources functions with the same kind of tools that typically are used by much bigger companies, is today announcing some funding to bulk up its own position: the company has raised $80 million, funding that it will be using to expand its operations geographically — specifically deeper into Latin American markets — and to continue to augment its product with more features.

CEO Jordi Romero, who co-founded the startup with Pau Ramon and Bernat Farrero — said in an interview that Factorial has seen a huge boom of growth in the last 18 months and counts more than anything 75,000 customers across 65 countries, with the average size of each customer in the range of 100 employees, although they can be significantly (single-digit) smaller or potentially up to 1,000 (the “M” of SMB, or SME as it’s often called in Europe).

“We have a generous definition of SME,” Romero said of how the company first started with a target of 10-15 employees but is now working in the size bracket that it is. “But that is the limit. This is the segment that needs the most help. We see other competitors of ours are trying to move into SME and they are screwing up their product by making it too complex. SMEs want solutions that have as much data as possible in one single place. That is unique to the SME.” Customers can include smaller franchises of much larger organizations, too: KFC, Booking.com, and Whisbi are among those that fall into this category for Factorial.

Factorial offers a one-stop shop to manage hiring, onboarding, payroll management, time off, performance management, internal communications and more. Other services such as the actual process of payroll or sourcing candidates, it partners and integrates closely with more localized third parties.

The Series B is being led by Tiger Global, and past investors CRV, Creandum, Point Nine and K Fund also participating, at a valuation we understand from sources close to the deal to be around $530 million post-money. Factorial has raised $100 million to date, including a $16 million Series A round in early 2020, just ahead of the Covid-19 pandemic really taking hold of the world.

That timing turned out to be significant: Factorial, as you might expect of an HR startup, was shaped by Covid-19 in a pretty powerful way.

The pandemic, as we have seen, massively changed how — and where — many of us work. In the world of desk jobs, offices largely disappeared overnight, with people shifting to working at home in compliance with shelter-in-place orders to curb the spread of the virus, and then in many cases staying there even after those were lifted as companies grappled both with balancing the best (and least infectious) way forward and their own employees’ demands for safety and productivity. Front-line workers, meanwhile, faced a completely new set of challenges in doing their jobs, whether it was to minimize exposure to the coronavirus, or dealing with giant volumes of demand for their services. Across both, organizations were facing economics-based contractions, furloughs, and in other cases, hiring pushes, despite being office-less to carry all that out.

All of this had an impact on HR. People who needed to manage others, and those working for organizations, suddenly needed — and were willing to pay for — new kinds of tools to carry out their roles.

But it wasn’t always like this. In the early days, Romero said the company had to quickly adjust to what the market was doing.

“We target HR leaders and they are currently very distracted with furloughs and layoffs right now, so we turned around and focused on how we could provide the best value to them,” Romero said to me during the Series A back in early 2020. Then, Factorial made its product free to use and found new interest from businesses that had never used cloud-based services before but needed to get something quickly up and running to use while working from home (and that cloud migration turned out to be a much bigger trend played out across a number of sectors). Those turning to Factorial had previously kept all their records in local files or at best a “Dropbox folder, but nothing else,” Romero said.

It also provided tools specifically to address the most pressing needs HR people had at the time, such as guidance on how to implement furloughs and layoffs, best practices for communication policies and more. “We had to get creative,” Romero said.

But it wasn’t all simple. “We did suffer at the beginning,” Romero now says. “People were doing furloughs and [frankly] less attention was being paid to software purchasing. People were just surviving. Then gradually, people realized they needed to improve their systems in the cloud, to manage remote people better, and so on.” So after a couple of very slow months, things started to take off, he said.

Factorial’s rise is part of a much, longer-term bigger trend in which the enterprise technology world has at long last started to turn its attention to how to take the tools that originally were built for larger organizations, and right size them for smaller customers.

The metrics are completely different: large enterprises are harder to win as customers, but represent a giant payoff when they do sign up; smaller enterprises represent genuine scale since there are so many of them globally — 400 million, accounting for 95% of all firms worldwide. But so are the product demands, as Romero pointed out previously: SMBs also want powerful tools, but they need to work in a more efficient, and out-of-the-box way.

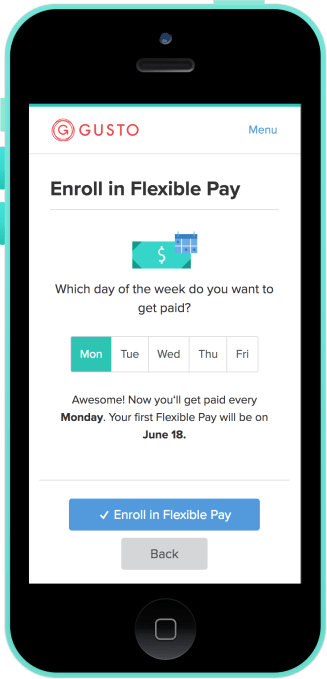

Factorial is not the only HR startup that has been honing in on this, of course. Among the wider field are PeopleHR, Workday, Infor, ADP, Zenefits, Gusto, IBM, Oracle, SAP and Rippling; and a very close competitor out of Europe, Germany’s Personio, raised $125 million on a $1.7 billion valuation earlier this year, speaking not just to the opportunity but the success it is seeing in it.

But the major fragmentation in the market, the fact that there are so many potential customers, and Factorial’s own rapid traction are three reasons why investors approached the startup, which was not proactively seeking funding when it decided to go ahead with this Series B.

“The HR software market opportunity is very large in Europe, and Factorial is incredibly well positioned to capitalize on it,” said John Curtius, Partner at Tiger Global, in a statement. “Our diligence found a product that delighted customers and a world-class team well-positioned to achieve Factorial’s potential.”

“It is now clear that labor markets around the world have shifted over the past 18 months,” added Reid Christian, general partner at CRV, which led its previous round, which had been CRV’s first investment in Spain. “This has strained employers who need to manage their HR processes and properly serve their employees. Factorial was always architected to support employers across geographies with their HR and payroll needs, and this has only accelerated the demand for their platform. We are excited to continue to support the company through this funding round and the next phase of growth for the business.”

Notably, Romero told me that the fundraising process really evolved between the two rounds, with the first needing him flying around the world to meet people, and the second happening over video links, while he was recovering himself from Covid-19. Given that it was not too long ago that the most ambitious startups in Europe were encouraged to relocate to the U.S. if they wanted to succeed, it seems that it’s not just the world of HR that is rapidly shifting in line with new global conditions.

Zenefits CEO Parker Conrad danced around a question about building out payroll services at Disrupt SF 2015. “I can’t announce anything about new products specifically, but you know payroll’s a very important spoke,” Conrad said at the time. But the cloud-based HR unicorn has built a payroll product, launching out of beta today.

Zenefits CEO Parker Conrad danced around a question about building out payroll services at Disrupt SF 2015. “I can’t announce anything about new products specifically, but you know payroll’s a very important spoke,” Conrad said at the time. But the cloud-based HR unicorn has built a payroll product, launching out of beta today.  Payroll startup ZenPayroll changed its name to Gusto today and is moving beyond payroll, into benefits such as health insurance and workers compensation.

Payroll startup ZenPayroll changed its name to Gusto today and is moving beyond payroll, into benefits such as health insurance and workers compensation. Intuit has quietly made another acquisition today to expand its accounting and back office management business, this time focusing on payroll. Acrede, a Jersey, UK-based provider of global, cross-border and cloud-based payroll services, is joining Inuit; and its CEO and founder, Karen Paterson, is being named Intuit’s director of payroll platform. Financial terms and other details of…

Intuit has quietly made another acquisition today to expand its accounting and back office management business, this time focusing on payroll. Acrede, a Jersey, UK-based provider of global, cross-border and cloud-based payroll services, is joining Inuit; and its CEO and founder, Karen Paterson, is being named Intuit’s director of payroll platform. Financial terms and other details of…