Robotic process automation has taken the enterprise world by storm by providing a set of tools for those doing repetitive, volume-based tasks to use software to remove some of that labor to let those people focus on more complicated tasks. Today a startup that’s taken some of that ethos and is applying it to more individualized work — that of salespeople — is announcing some funding.

Dooly, a Vancouver, Canada-based startup that has built a set of AI-based tools that automate the busywork that goes into updating data in their sales software, and namely Salesforce, has picked up $20 million in funding to build out its business, which to date has picked up a number of customers among the sales teams of enterprise-focused software companies. They include Airtable, Asana, Intercom, Contentful, Vidyard, BigCommerce, Liftoff and CrowdRiff.

Its aim is to make sales software more useful for salespeople by eliminating the work that goes into inputting data into those systems.

“Really they’ve just created a mountain of virtual filing cabinets,” Kris Hartvigsen, Dooly’s founder and CEO, said in an emailed interview with me. “Filing cabinets just wait for drawers to be opened — or in the case of enterprise software, reports to be pulled and data to be input. We know people are capturing information across the business and our job is to make sure that the people and systems across the business have a better, faster, more far-reaching way of staying informed.”

The funding is being announced today, but it was actually raised in two tranches that had not previously been disclosed. A $3.3 million seed round was led by Boldstart Ventures and also included BoxGroup. Its $17 million Series A, meanwhile, was led by Addition, with Boldstart and BoxGroup again participating, along with Battery Ventures, Mantis (representing musicians The Chainsmokers) and SV Angel.

Alongside the VCs, there are a number of interesting strategic individual investors, too. Daniel Dines and Brandon Deer of UiPath (the RPA connection clearly is not one that I’m imagining!); Allison Pickens, the ex-COO of Gainsight; Zander Lurie of SurveyMonkey); Jay Simons, ex-CEO of Atlassian); Harry Stebbings; and other unnamed investors are all also involved. Ed Sim of Boldstart is joining Dooly’s board of directors with this announcement.

The challenge that Dooly has been built to solve is that while there are a lot of tools out there now to help salespeople source leads, manage the progress of their sales, give them advice and other helpful material to supplement their charm and the basic strength of a product, manage customers once they’ve signed on, and so on, all of them still require something important to work: a time commitment from salespeople to keep them updated with information. Ironically, the more tools to help them that are built, the more time salespeople need to spend feeding them data.

Even more ironically, one of the big daddies of the problem — the somewhat overweight Salesforce — has published figures (cited by Dooly) that say salespeople spend just 34% of their time selling. The rest (minus trips to get coffee to stay caffeinated) seems to be about data entry.

The idea with Dooly is that you turn it on, connect it to what you are using — starting with Salesforce — and Dooly lets you make notes which it then organises and puts into the right places in the rest of your apps.

“When a salesperson starts using Dooly, the ‘aha moment’ is pretty immediate,” Hartvigsen said. “Whether they want to do quick pipeline edits or push their notes to Salesforce, we don’t ask the user to learn any new patterns they aren’t familiar with, we just automate a bunch of things they hate doing, often comparing those traditional chores to clerical work.” For example, he notes, when they sync a note, Dooly automatically updates any Salesforce with any contacts found in the meeting, updates fields, adds to-dos, logs activities, and pushes messages to the appropriate internal stakeholders on Slack, all in the same motion.

The product currently also integrates with Slack, G-Cal and G-Drive, because, Hartvigsen said, “we see this as an area where there is the most immediate friction and an area that was in need of disruption.” He added that the plan is to add more integrations over time. “We see need to expand the solutions that anchor to our connected workspace, with our near-term focus being the systems that touch revenue teams,” he said.

The design of Dooly seems to be about investing a little in order to save more. On average people are using Dooly between 2.5 and 5 hours each day, but Hartvigsen claims that right now the system helps people make up for more hours each week in lost productivity. Its pricing starts at $25 per user per month, going up depending on features and use.

There are quite literally thousands of products out in the market today, and among them hundreds of strong ones, being built to help salespeople with different aspects of getting their jobs done. I’ve written about quite a few of them, and I’ve actually asked companies about whether they are tackling the very issue that Dooly has identified and is trying to fix.

They weren’t, but that doesn’t mean that they won’t. Chief among them are companies like UiPath and Salesforce, which sit on different sides of this problem and could well move into it as they keep growing. (Having UiPath as a backer by way of its founder and a senior executive points to a relationship there, which is interesting.)

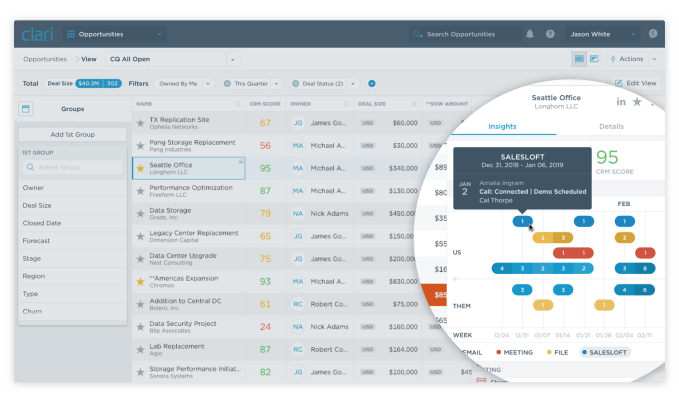

In the meantime, there have been some other interesting innovations using AI to improve the sales process, with companies like Pipedrive, Clari, Seismic, Chorus.ai and Gong all using natural language, machine learning and big data analytics (itself helped by AI) to improve how sales get done.

“The first thing we noticed when we met the Dooly team was the thoughtful design-first approach to product that engendered tons of customer love. This love was inherent not only on popular ratings sites like G2 Crowd but also in the individual usage and viral adoption throughout companies with only one initial user,” said Ed Sim, founder and managing partner at Boldstart Ventures in a statement. “Dooly is revolutionizing the note-taking experience for customer facing end users from sales to customer success to product.”

“Dooly is relentlessly focused on building a user-first experience for its customers to seamlessly create workflows and unlock new revenue opportunities,” said Lee Fixel, founder of Addition, added. “We are thrilled to support Dooly as it continues to scale and enhance the sales function for more businesses.”

Last fall at Dreamforce, Google and Salesforce announced a partnership. Today, the two companies unveiled the first pieces of that agreement. For starters, Google Analytics 360 users can now import data from the Salesforce CRM tool such as leads and opportunities, among other pieces. This could allow marketers to have a more complete view of the customer journey from first contact to sale…

Last fall at Dreamforce, Google and Salesforce announced a partnership. Today, the two companies unveiled the first pieces of that agreement. For starters, Google Analytics 360 users can now import data from the Salesforce CRM tool such as leads and opportunities, among other pieces. This could allow marketers to have a more complete view of the customer journey from first contact to sale…