Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

VMware is closing the year with a significant new component in its arsenal. Today it announced it has closed the $2.7 billion Pivotal acquisition it originally announced in August.

The acquisition gives VMware another component in its march to transform from a pure virtual machine company into a cloud native vendor that can manage infrastructure wherever it lives. It fits alongside other recent deals like buying Heptio and Bitnami, two other deals that closed this year.

They hope this all fits neatly into VMware Tanzu, which is designed to bring Kubernetes containers and VMware virtual machines together in a single management platform.

“VMware Tanzu is built upon our recognized infrastructure products and further expanded with the technologies that Pivotal, Heptio, Bitnami and many other VMware teams bring to this new portfolio of products and services,” Ray O’Farrell, executive vice president and general manager of the Modern Application Platforms Business Unit at VMware, wrote in a blog post announcing the deal had closed.

Craig McLuckie, who came over in the Heptio deal and is now VP of R&D at VMware, told TechCrunch in November at KubeCon that while the deal hadn’t closed at that point, he saw a future where Pivotal could help at a professional services level, as well.

“In the future when Pivotal is a part of this story, they won’t be just delivering technology, but also deep expertise to support application transformation initiatives,” he said.

Up until the closing, the company had been publicly traded on the New York Stock Exchange, but as of today, Pivotal becomes a wholly owned subsidiary of VMware. It’s important to note that this transaction didn’t happen in a vacuum, where two random companies came together.

In fact, VMware and Pivotal were part of the consortium of companies that Dell purchased when it acquired EMC in 2015 for $67 billion. While both were part of EMC and then Dell, each one operated separately and independently. At the time of the sale to Dell, Pivotal was considered a key piece, one that could stand strongly on its own.

Pivotal and VMware had another strong connection. Pivotal was originally created by a combination of EMC, VMware and GE (which owned a 10% stake for a time) to give these large organizations a separate company to undertake transformation initiatives.

It raised a hefty $1.7 billion before going public in 2018. A big chunk of that came in one heady day in 2016 when it announced $650 million in funding led by Ford’s $180 million investment.

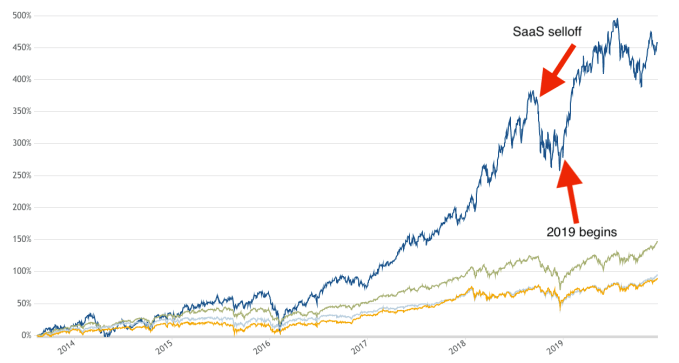

The future looked bright at that point, but life as a public company was rough, and after a catastrophic June earnings report, things began to fall apart. The stock dropped 42% in one day. As I wrote in an analysis of the deal:

The stock price plunged from a high of $21.44 on May 30th to a low of $8.30 on August 14th. The company’s market cap plunged in that same time period falling from $5.828 billion on May 30th to $2.257 billion on August 14th. That’s when VMware admitted it was thinking about buying the struggling company.

VMware came to the rescue and offered $15.00 a share, a substantial premium above that August low point. As of today, it’s part of VMware.