Trust wants to give smaller businesses the same advantages that large enterprises have when marketing on digital and social media platforms. It came out of beta with $9 million in seed funding from Lerer Hippeau, Lightspeed Venture Partners, Upfront Ventures and Upper90.

The Los Angeles-based company was started in 2019 by a group of five Snap alums working in various roles within Snap’s revenue product strategy business. They were building tools for businesses to fund success with digital marketing, but kept hearing from customers about the advantage big advertisers had over smaller ones — the ability to receive good payment terms, credit lines, as well as data and advice.

Aiming to flip the script on that, the group created Trust, which is a card and business community to help digital businesses navigate the ever-changing pricing models to market online, receive the same incentives larger advertisers get and make the best decision of where their marketing dollars will reach the furthest.

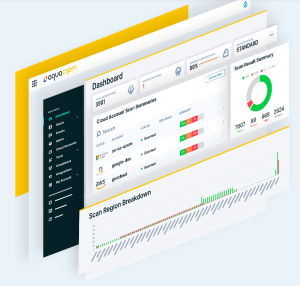

Trust dashboard

Trust does this in a few ways: Its card, built in partnership with Stripe, enables businesses to increase their buying power by up to 20 times and have 45 days to make payments on their marketing investments, CEO James Borow told TechCrunch. Then as part of its community, companies share knowledge of marketing buys and data insights typically reserved for larger advertisers. Users even receive news via their dashboard around their specific marketing strategy, he added.

“The ad platforms are walled gardens, and most people don’t know what is going on inside, so our customers work together to see what is going on,” Borow said.

The growth of e-commerce is pushing more digital marketing investments, providing opportunity for Trust to be a huge business, Borow said. E-commerce sales in the U.S. grew by 39% in the first quarter, while digital advertising spend is forecasted to increase 25% this year to $191 billion. Meanwhile, Google, Facebook, Snapchat and Twitter all recently reported rapid growth in their year-over-year advertising revenues, Borow said.

The new funding will go toward increasing the company’s headcount.

“We have active customers on the platform, so we wanted to ramp up hiring as soon as we went into general release,” he added. “We are leaving beta with 25 businesses and a few hundred on our waitlist.”

That list will soon grow. In addition to the funding round, Trust announced a strategic partnership with social shopping e-commerce platform Verishop. The company’s 3,500 merchants will receive priority access to the Trust card and community, Borow said.

Andrea Hippeau, partner at Lerer Hippeau, said she knew Borow from being an investor in his previous advertising company Shift, which was acquired by Brand Networks in 2015.

When Borow contacted Lerer about Trust, Hippeau said this was the kind of offering that would be applicable to the firm’s portfolio, which has many direct-to-consumer brands, and knew marketing was a huge pain point for them.

“Digital marketing is important to all brands, but it is also a black box that you put marketing dollars into, but don’t know what you get,” she said. “We hear this across our portfolio — they spend a lot of money on ad platforms, yet are treated like mom-and-pop companies in terms of credit. When in reality Casper is outspending other companies by five times. Trust understands how important marketing dollars are and gives them terms that are financially better.”