Data may be the new oil, but it’s only valuable if you make good use of it. Today, a startup that has built a new kind of production analytics platform for developers, security engineers, and data scientists to track and better understand how data is moving around their networks is announcing a round of funding that underscores the demand for their technology.

Coralogix, which provides stateful streaming services to engineering teams, has picked up $55 million in a Series C round of funding.

The round was led by Greenfield Partners, with Red Dot Capital Partners, StageOne Ventures, Eyal Ofer’s O.G. Tech, Janvest Capital Partners, Maor Investments and 2B Angels also participating.

This Series C is coming about 10 months after the company’s Series B of $25 million, and from what we understand, Coralogix’s valuation is now in the range of $300 million to $400 million, a big jump for the startup, coming on the back of it growing 250% since this time last year, racking up some 2,000 paying customers, with some small teams paying as little as $100/year and large enterprises paying $1.5 million/year.

Previously, Coralogix — founded in Tel Aviv and with an HQ also in San Francisco — had also raised a round of $10 million.

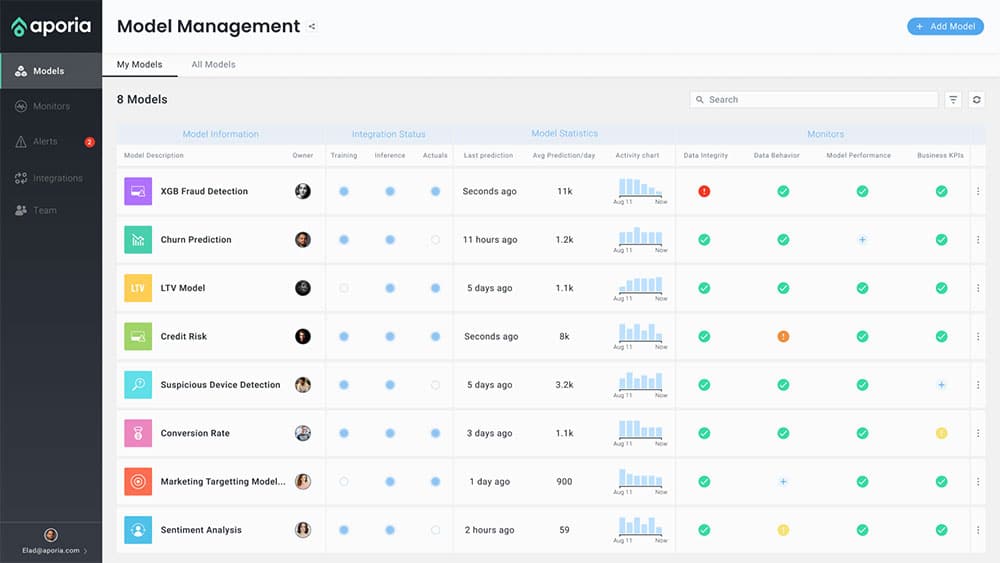

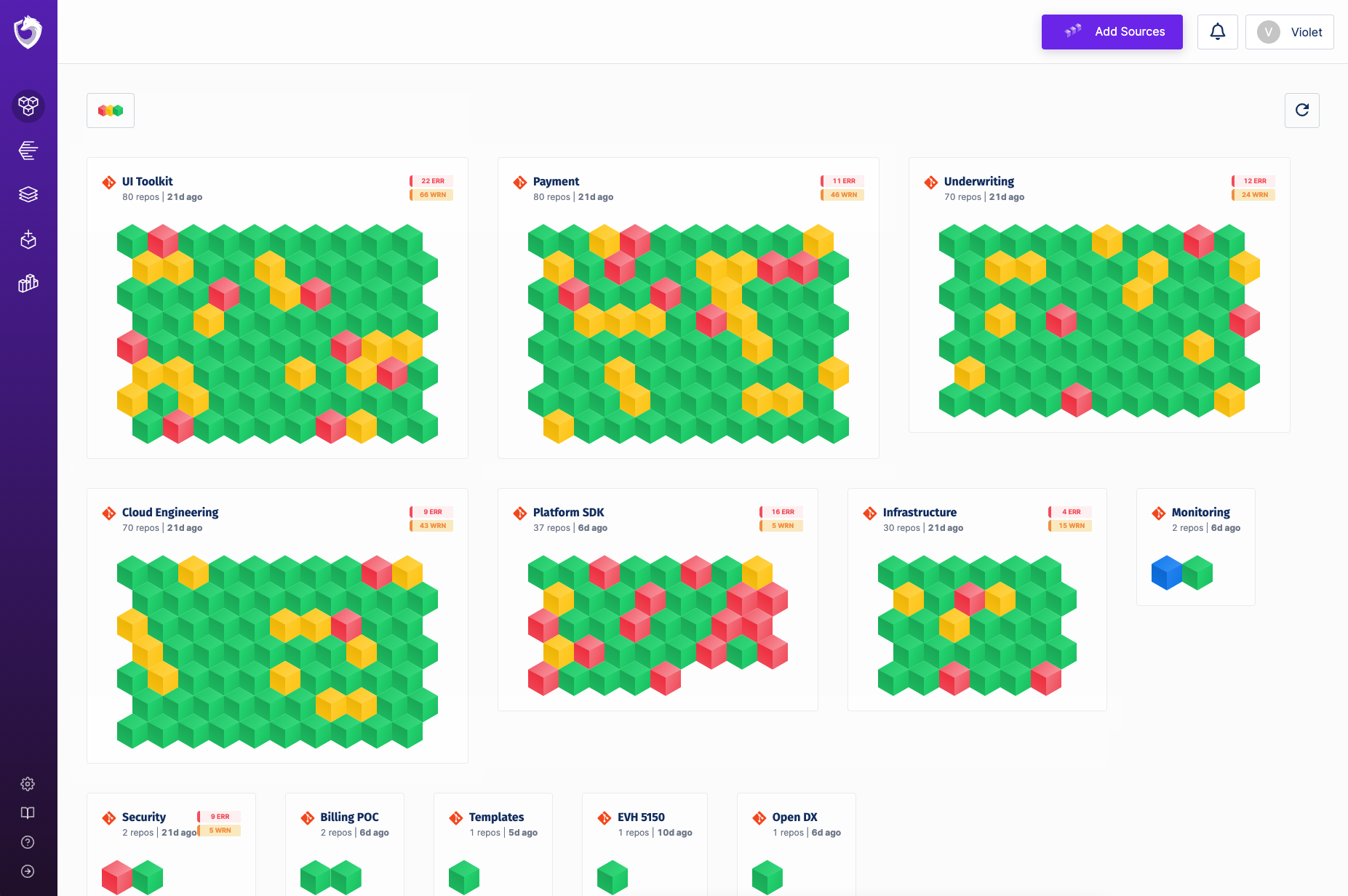

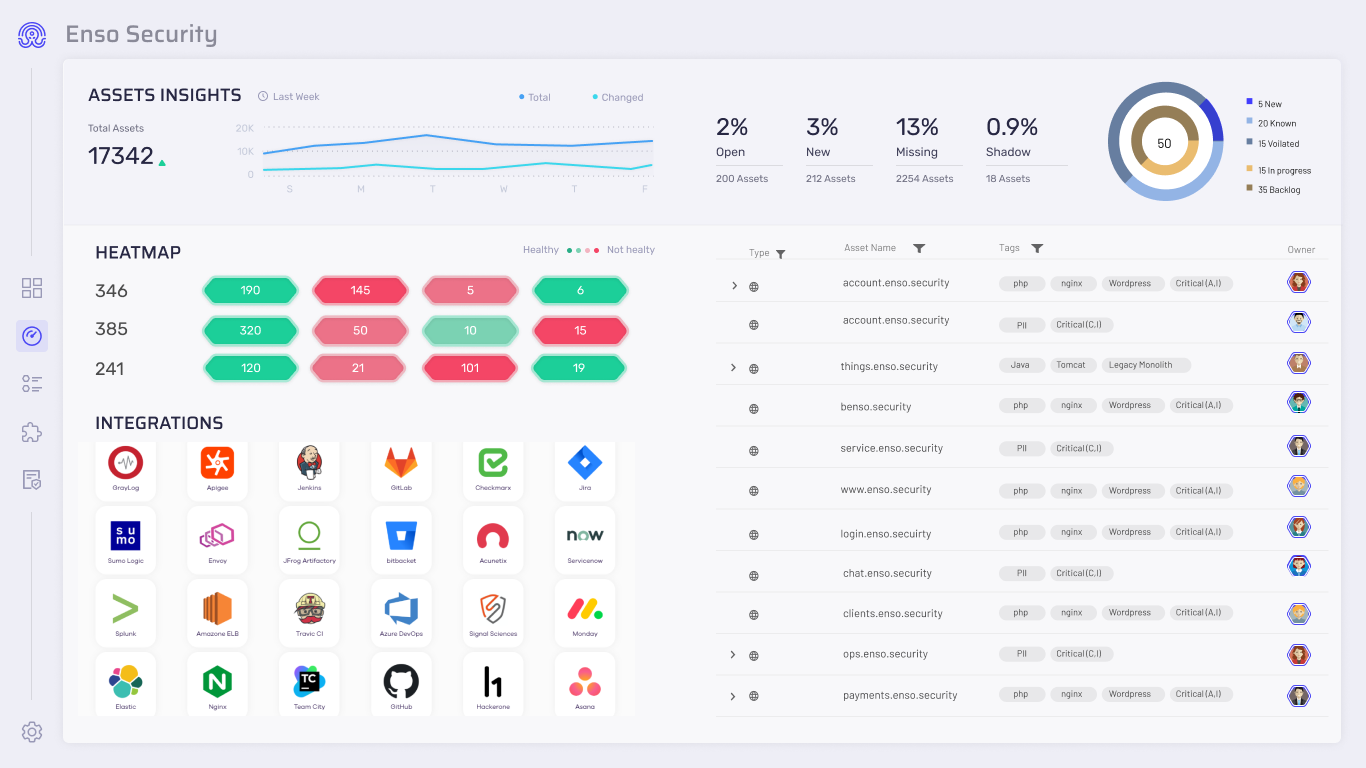

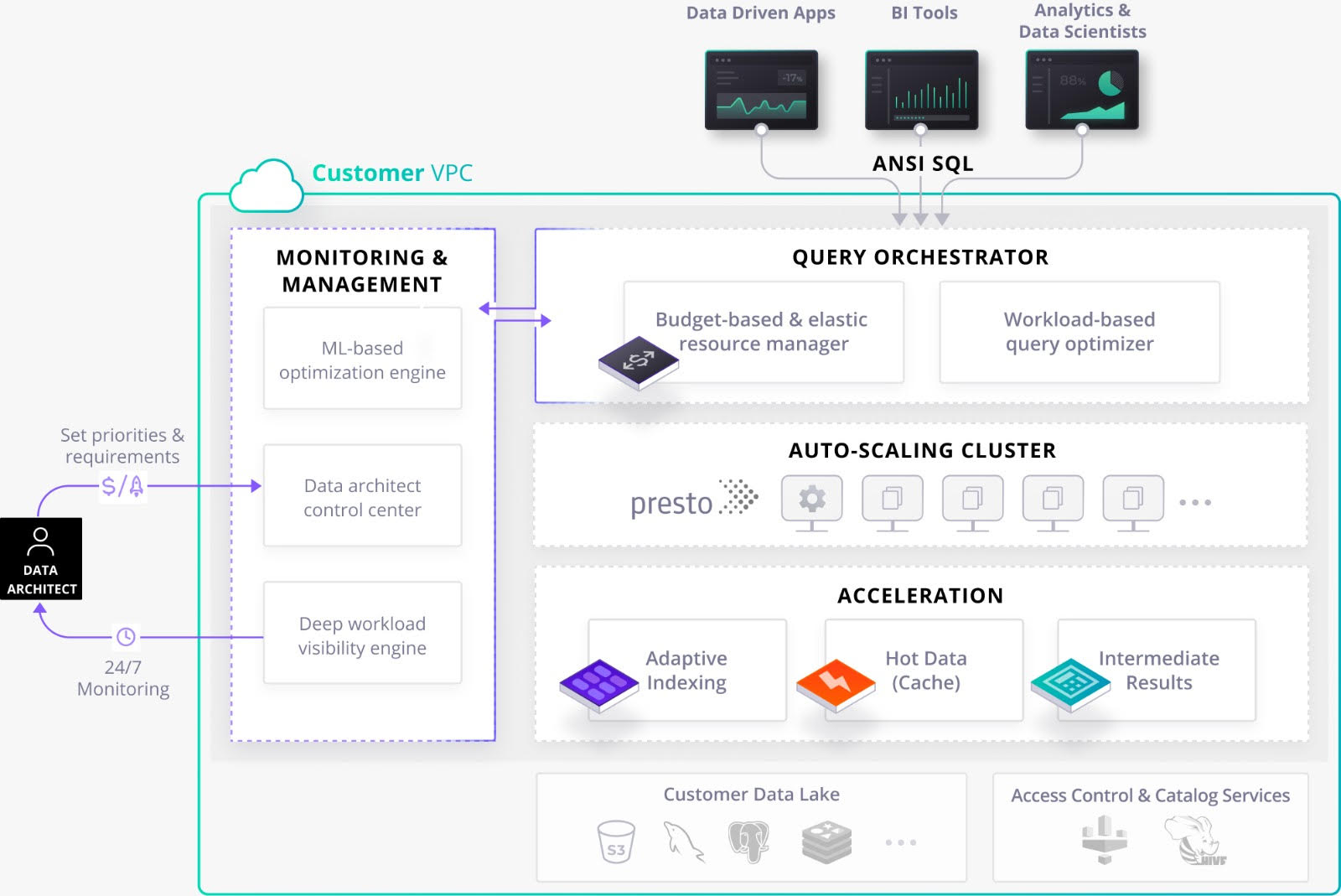

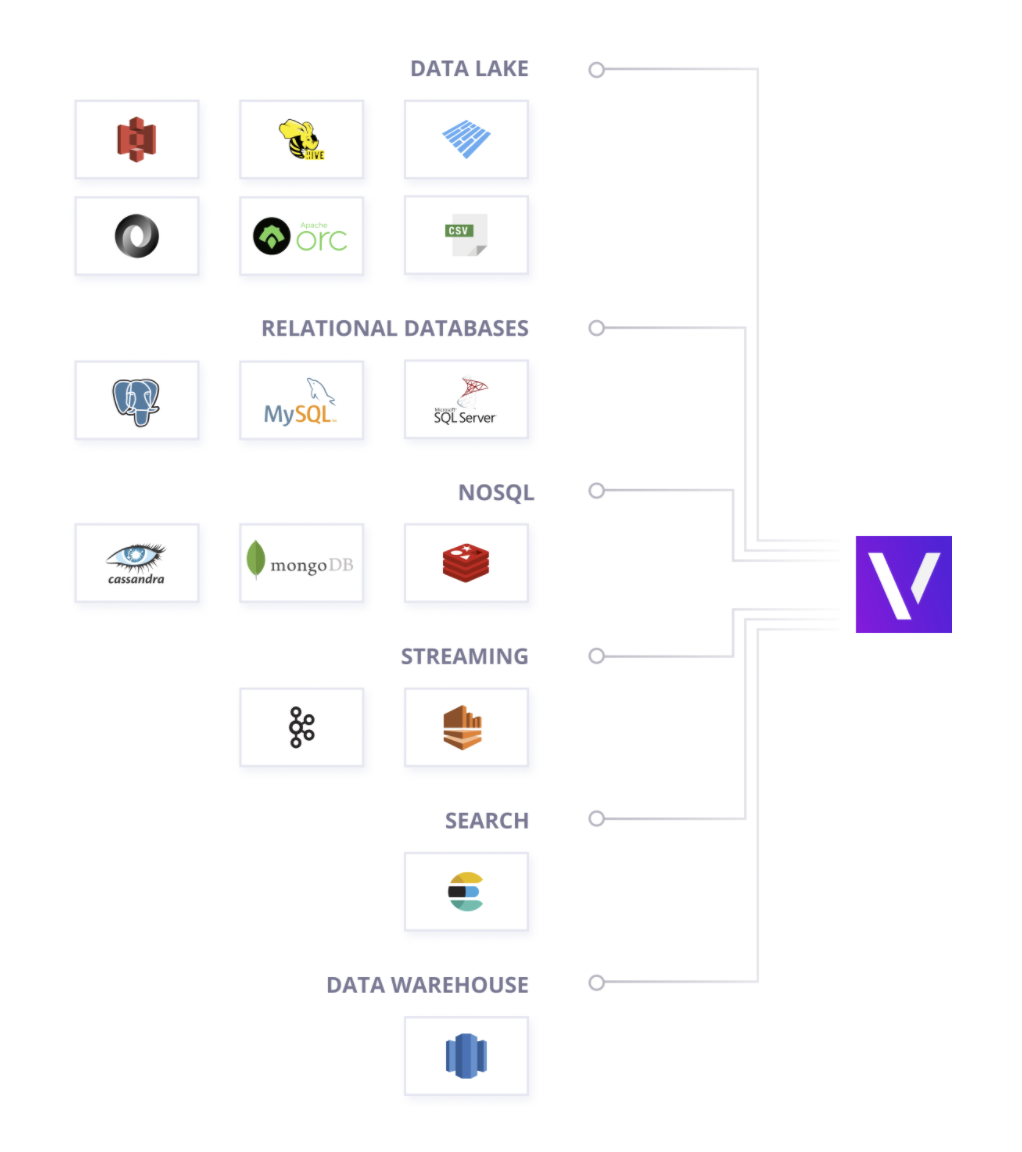

Coralogix got its start as a platform aimed at quality assurance support for R&D and engineering teams. The focus here is on log analytics and metrics for platform engineers, and this still forms a big part of its business today. Added to that, in recent years, Coralogix’s tools are being applied to cloud security services, contributing to a company’s threat intelligence by providing a way to observe data for any inconsistencies that typically might point to a breach or another incident. (It integrates with Alien Vault and others for this purpose.)

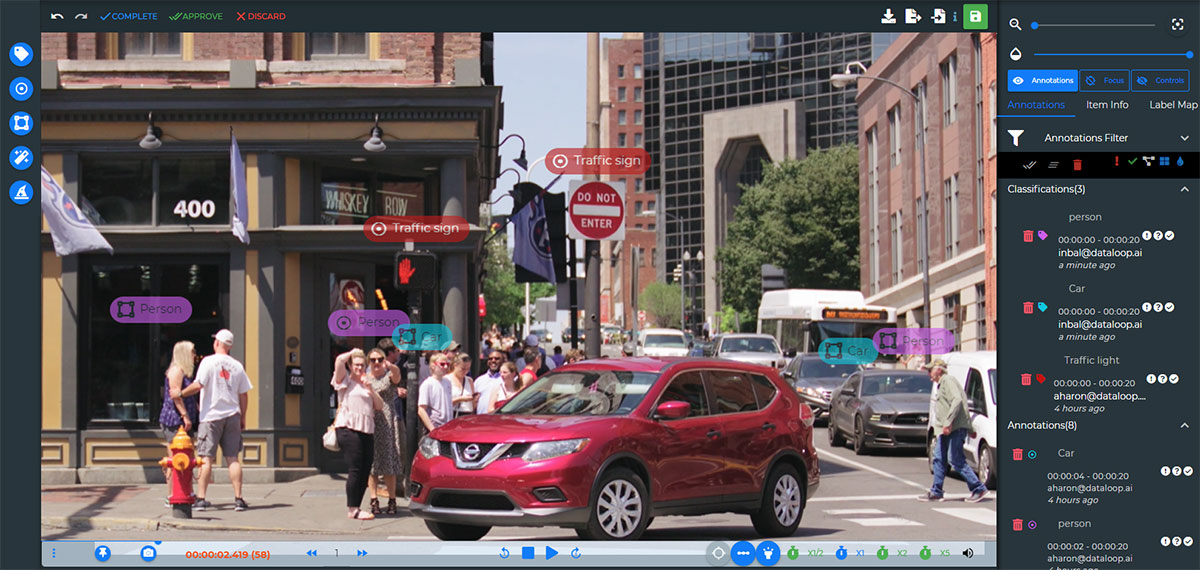

The third area that is just picking up now and will be developed further — one of the uses of this investment, in fact — will be to develop how Coralogix is used for business intelligence. This is a particularly interesting area because it plays into how Coralogix is built, to provide analytics on data before it is indexed.

“It’s about high-volume, but low-value data,” Ariel Assaraf, Coralogix’s CEO, said in an interview. “Customers don’t want to store the data [or index it] but want to view it live and visualize it. We are starting to see a use case where business information and our analytics come together for sentiment analysis and other areas.”

There are dozens of strong companies providing tools these days to cover log analytics and data observability, underscoring the general growth and importance of DevOps these days. They include companies like DataDog, Sumo Logic and Splunk.

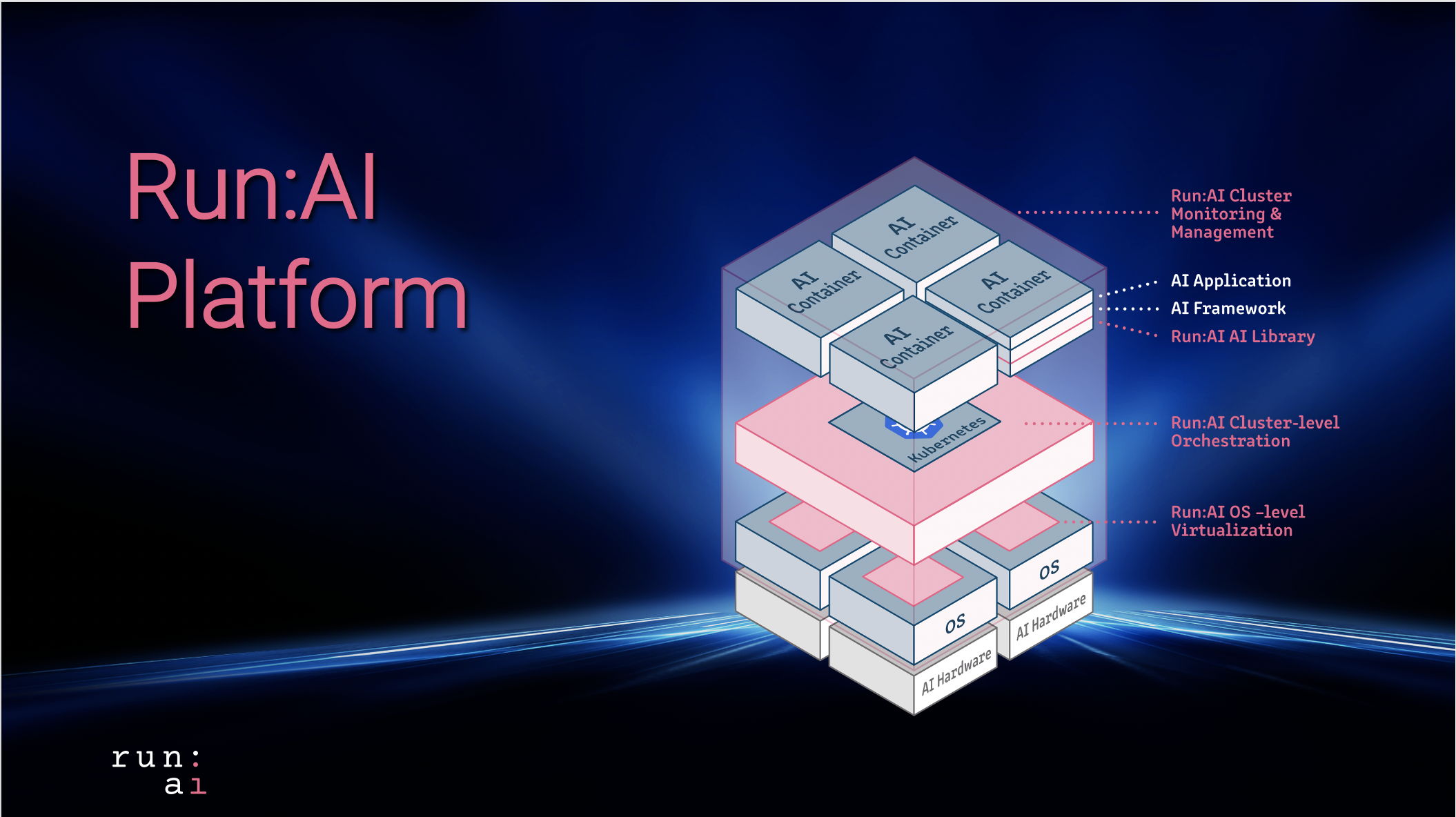

However, Assaraf believes that what sets his company apart is its approach: Essentially, it has devised a way of observing and analyzing data streams before they get indexed, giving engineers more flexibility to query the data in different ways and glean more insights, faster. The other issue with indexing, he said, is that it impacts latency, which also has a big impact on overall costs for an organization.

For many of Coralogix’s competitors, turning around the nature of the business to focus not first on indexing would be akin to completely rebuilding the business, hard to do at their scale (although this is what Coralogix did when it pivoted as a small company several years ago, which is when Assaraf took on the role of CEO). One company he believes might be more of a direct rival is Confluent.

“I think we will see Confluent getting into observability very soon because they have the streaming capabilities,” he said, “but not the tools we have.” Another potential competitor looming on the horizon: Salesforce, and its potential move into that area, underscores the shifting sands of what is powering enterprise IT investment decisions today.

Salesforce already has Heroku, Slack and Tableau, three major tools developers use for tracking and working with data, Assaraf pointed out, and there were strong rumors of it trying to buy DataDog, “so we definitely see where they are going. For sure, they understand the way things are changing. All the budgets when Salesforce first started were in marketing and sales. Now you sell to IT. Salesforce understands that shift to developers, and so that is where they are going.”

It makes for a very interesting landscape and future for companies like Coralogix, one that investors believe the startup will continue to shape as it has up to now.

“The dramatic shift in digital transformation is generating an explosion of data, which until now has forced enterprises to decide between cost and coverage,” said Shay Grinfeld, managing partner at Greenfield Partners. “Coralogix’s real-time streaming analytics pipeline employs proprietary algorithms to break this tradeoff and generate significant cost savings. Coralogix has built a customer roster that comprises some of the largest and most innovative companies in the world. We’re thrilled to partner with Ariel and the Coralogix team on their journey to reinvent the future of data observability.”