At a time when remote work, cybersecurity attacks and increased privacy and compliance requirements threaten a company’s data, more companies are collecting and storing their observability data, but are being locked in with vendors or have difficulty accessing the data.

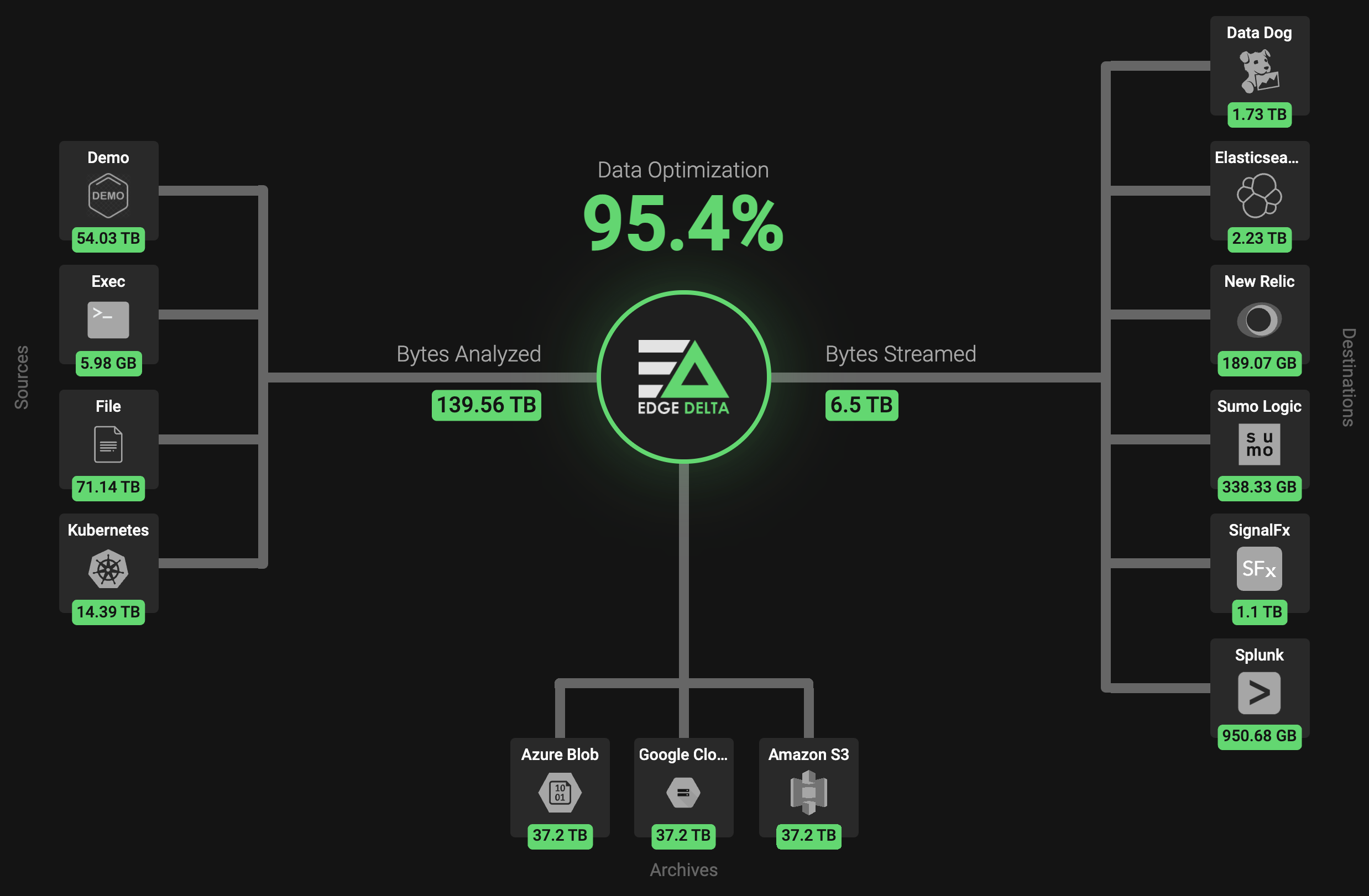

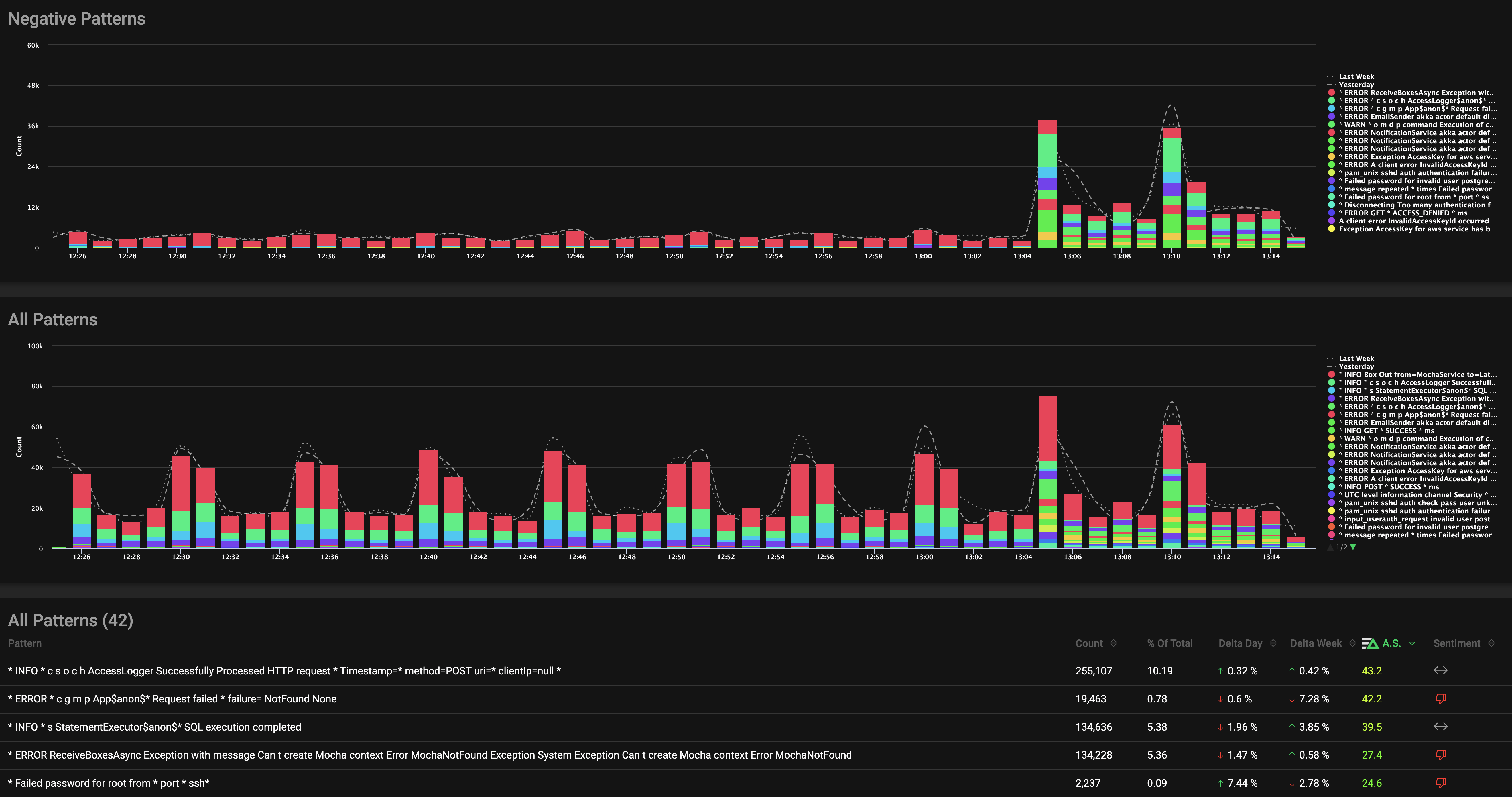

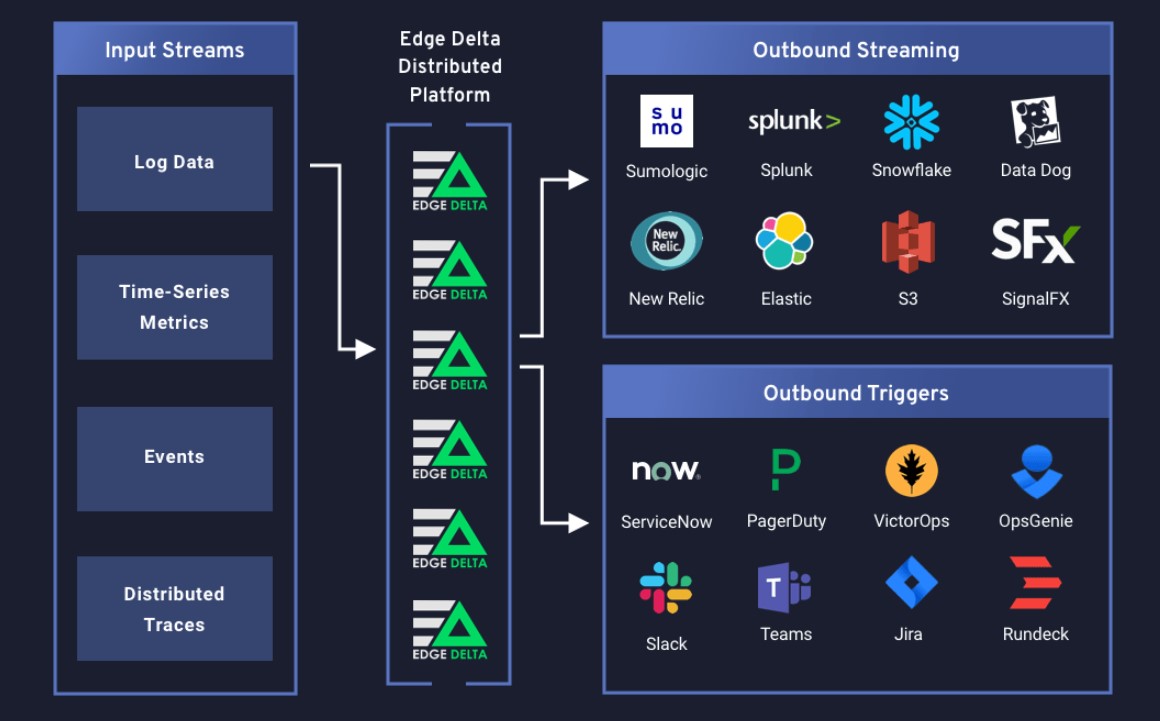

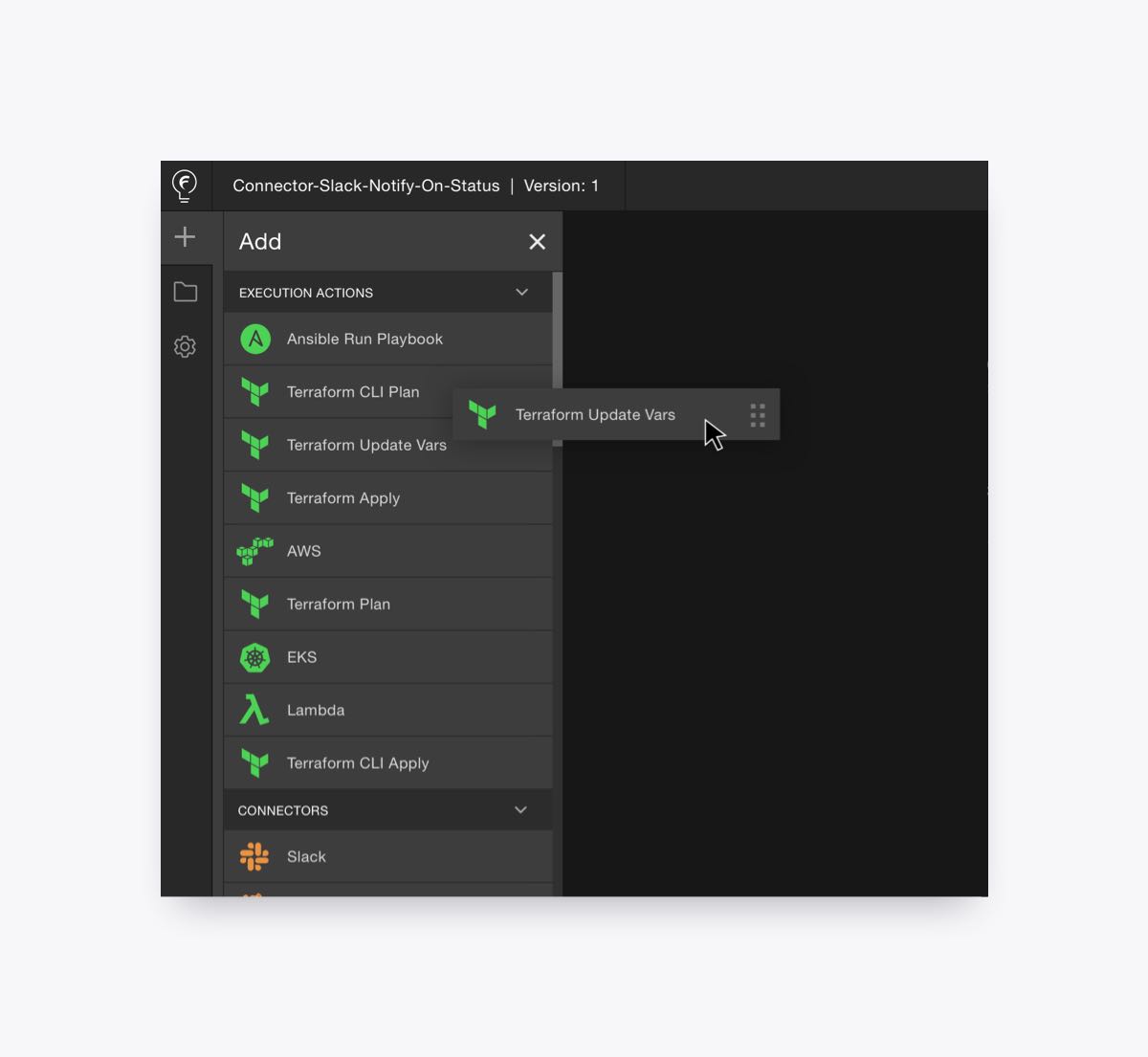

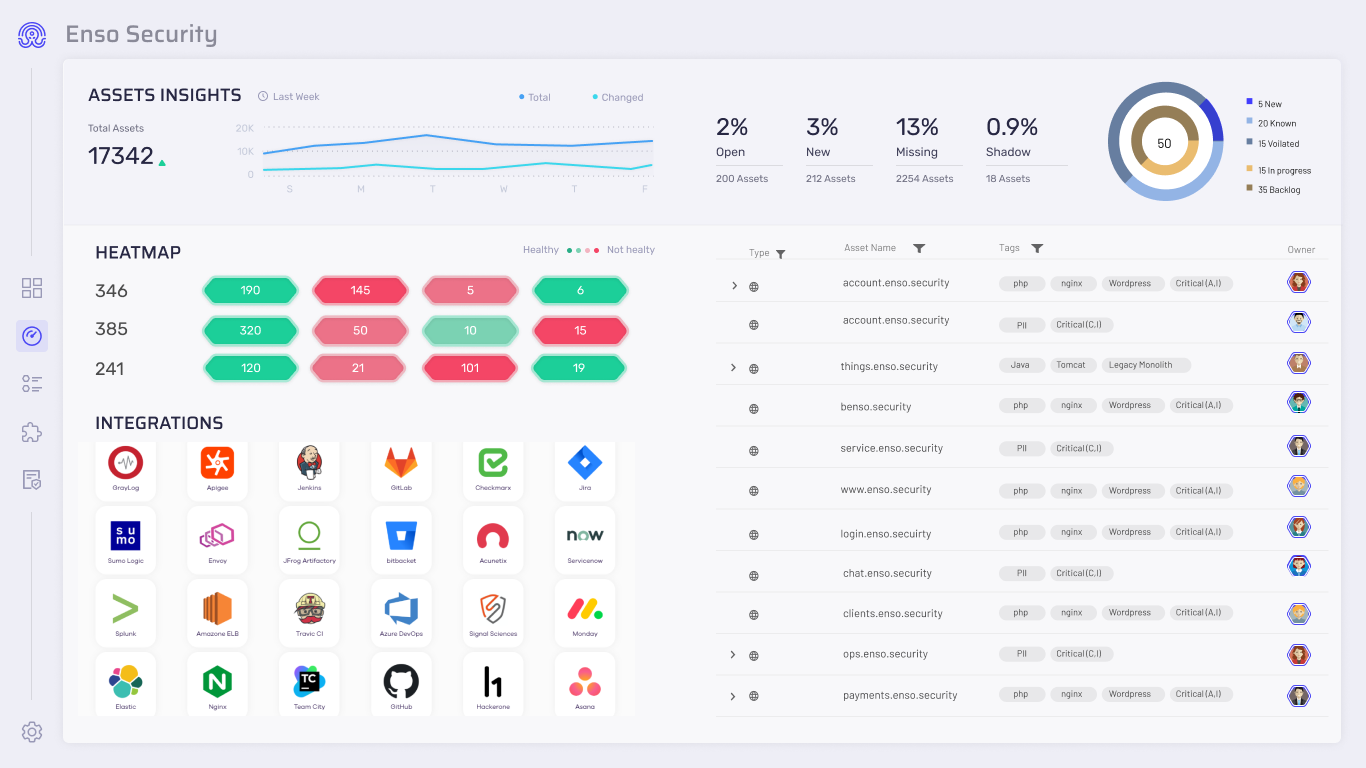

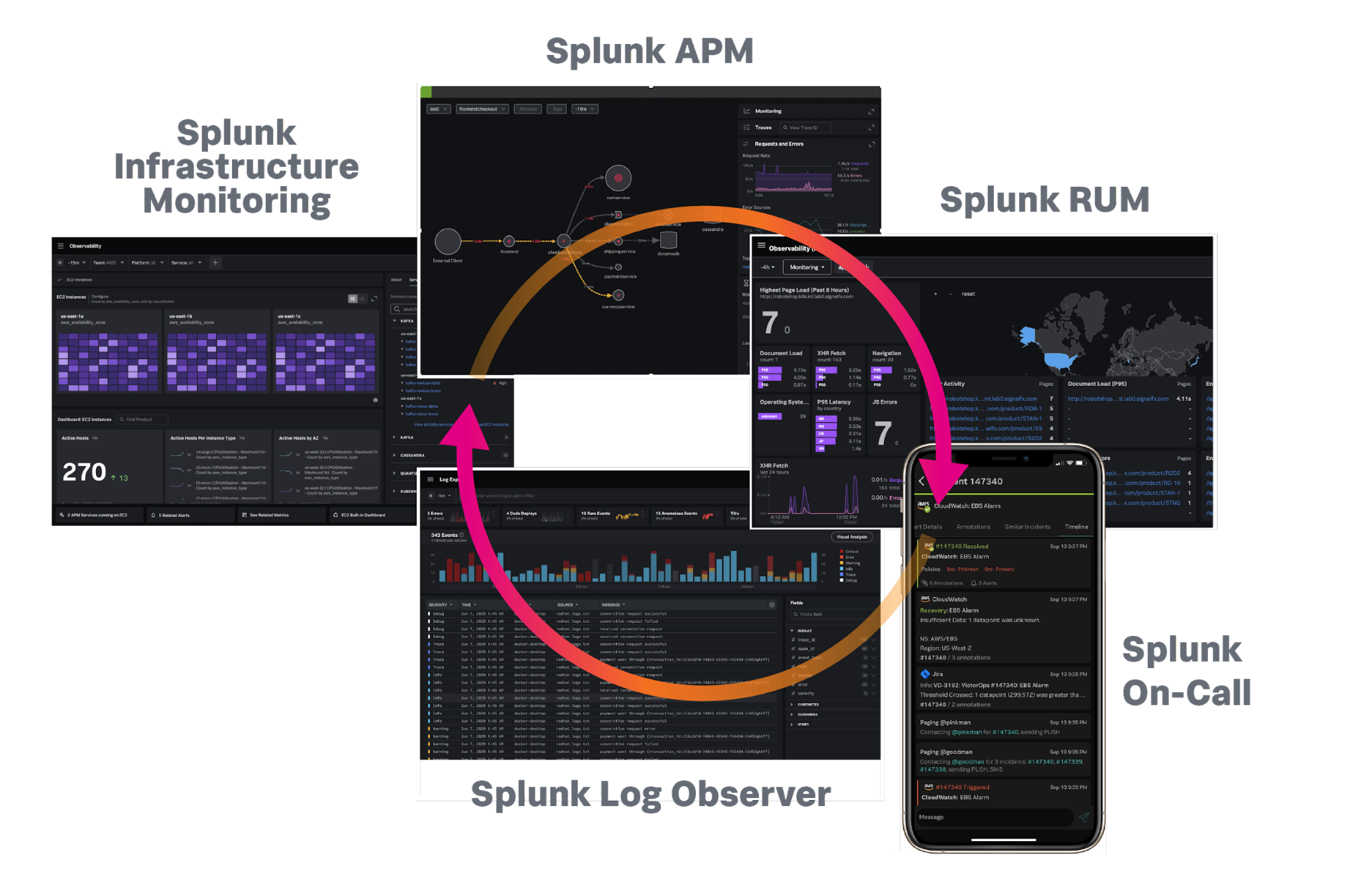

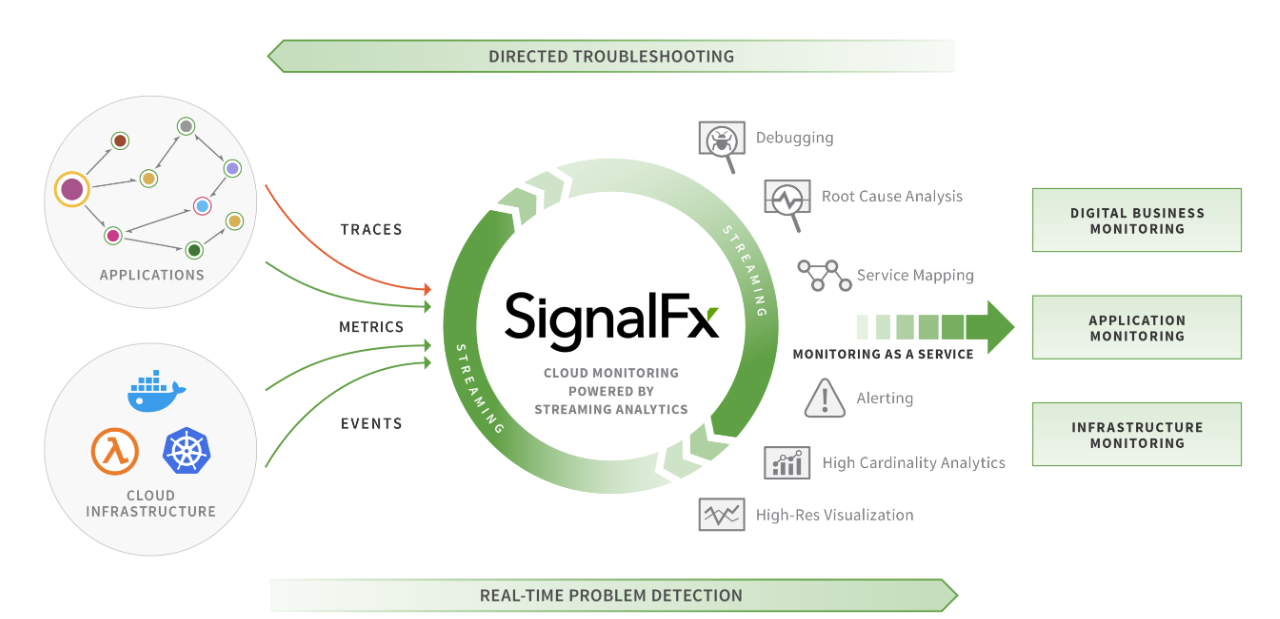

Enter Cribl. The San Francisco-based company is developing an “open ecosystem of data” for enterprises that utilizes unified data pipelines, called “observability pipelines,” to parse and route any type of data that flows through a corporate IT system. Users can then choose their own analytics tools and storage destinations like Splunk, Datadog and Exabeam, but without becoming dependent on a vendor.

The company announced Wednesday a $200 million round of Series C funding to value Cribl at $1.5 billion, according to a source close to the company. Greylock and Redpoint Ventures co-led the round and were joined by new investor IVP, existing investors Sequoia and CRV and strategic investment from Citi Ventures and CrowdStrike. The new capital infusion gives Cribl a total of $254 million in funding since the company was started in 2017, Cribl co-founder and CEO Clint Sharp told TechCrunch.

Sharp did not discuss the valuation; however, he believes that the round is “validation that the observability pipeline category is legit.” Data is growing at a compound annual growth rate of 25%, and organizations are collecting five times more data today than they did 10 years ago, he explained.

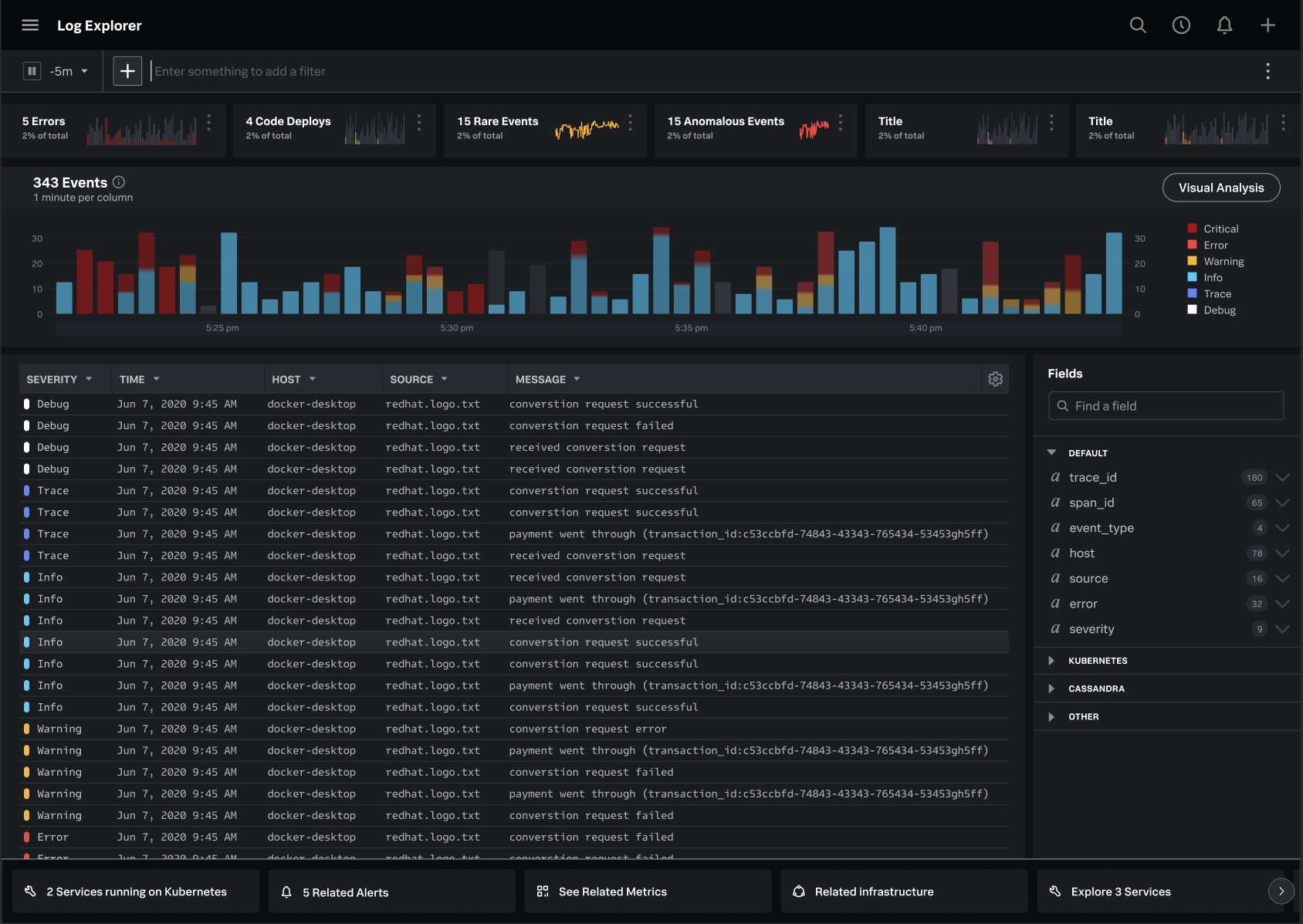

“Ultimately, they want to ask and answer questions, especially for IT and security people,” Sharp added. “When Zoom sends data on who started a phone call, that might be data I need to know so I know who is on the call from a security perspective and who they are communicating with. Also, who is sending files to whom and what machines are communicating together in case there is a malicious actor. We can also find out who is having a bad experience with the system and what resources they can access to try and troubleshoot the problem.”

Cribl also enables users to choose how they want to store their data, which is different from competitors that often lock companies into using only their products. Instead, customers can buy the best products from different categories and they will all talk to each other through Cribl, Sharp said.

Though Cribl is developing a pipeline for data, Sharp sees it more as an “observability lake,” as more companies have differing data storage needs. He explains that the lake is where all of the data will go that doesn’t need to go into an existing storage solution. The pipelines will send the data to specific tools and then collect the data, and what doesn’t fit will go back into the lake so companies have it to go back to later. Companies can keep the data for longer and more cost effectively.

Cribl said it is seven times more efficient at processing event data and boasts a customer list that includes Whole Foods, Vodafone, FINRA, Fannie Mae and Cox Automotive.

Sharp went after additional funding after seeing huge traction in its existing customer base, saying that “when you see that kind of traction, you want to keep doubling down.” His aim is to have a presence in every North American city and in Europe, to continue launching new products and growing the engineering team.

Up next, the company is focusing on go-to-market and engineering growth. Its headcount is 150 currently, and Sharp expects to grow that to 250 by the end of the year.

Over the last fiscal year, Cribl grew its revenue 293%, and Sharp expects that same trajectory for this year. The company is now at a growth stage, and with the new investment, he believes Cribl is the “future leader in observability.”

“This is a great investment for us, and every dollar, we believe, is going to create an outsized return as we are the only commercial company in this space,” he added.

Scott Raney, managing director at Redpoint Ventures, said his firm is a big enterprise investor in software, particularly in companies that help organizations leverage data to protect themselves, a sweet spot that Cribl falls into.

He feels Sharp is leading a team, having come from Splunk, that has accomplished a lot, has a vision and a handle on the business and knows the market well. Where Splunk is capturing the machine data and using its systems to extract the data, Cribl is doing something similar in directing the data where it needs to go, while also enabling companies to utilize multiple vendors and build apps to sit on top of its infrastructure.

“Cribl is adding opportunity by enriching the data flowing through, and the benefits are going to be meaningful in cost reduction,” Raney said. “The attitude out there is to put data in cheaper places, and afford more flexibility to extract data. Step one is to make that transition, and step two is how to drive the data sitting there. Cribl is doing something that will go from being a big business to a legacy company 30 years from now.”